Convertir facilement : de 400 ml à centilitres

Dans le monde des mesures de volume, la conversion entre différentes unités…

Les meilleures solutions pour une prise de notes productive et une organisation optimale au travail

Dans un monde professionnel de plus en plus exigeant et rapide, l'efficacité…

Choisissez le logiciel de comptabilité adapté à votre entreprise grâce à ces critères indispensables

Dans le monde des affaires, la gestion efficace des finances est un…

Les clés pour concevoir des présentations PowerPoint percutantes et mémorables

Dans l'univers professionnel d'aujourd'hui, l'art de la présentation efficace est une compétence…

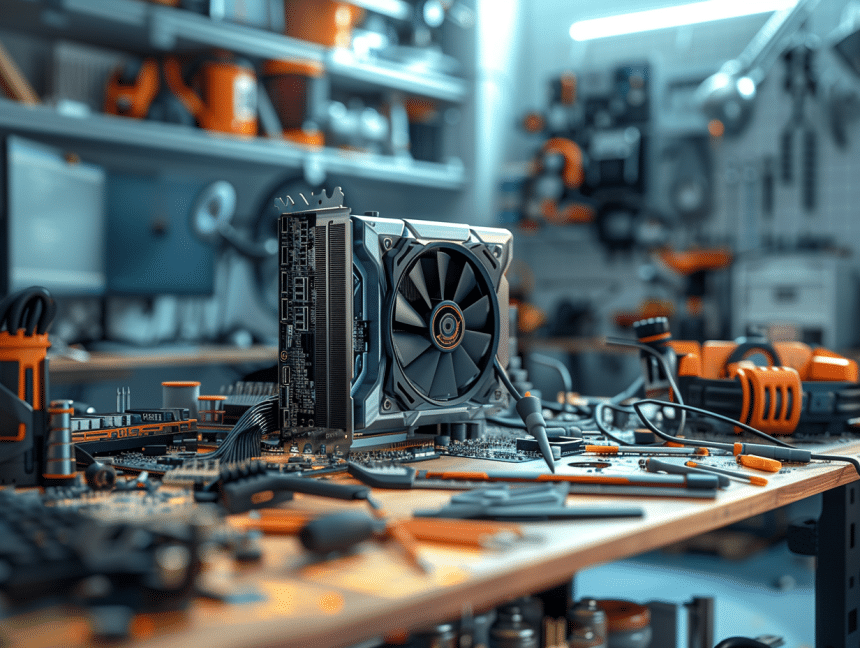

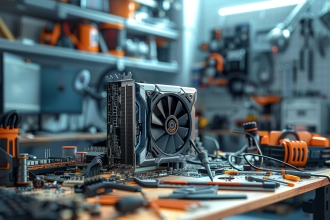

Réparation ventilateur GPU défectueux : solutions et astuces pratiques

Les cartes graphiques sont des composants essentiels pour les performances graphiques d'un ordinateur, en particulier pour les applications gourmandes telles…

Webmail AC Aix-Marseille : restez connecté à votre vie académique

Dans le monde dynamique de l'éducation, la communication numérique est essentielle. Pour…

Calcul de charge admissible pour poutre IPN : astuces et méthodes

Lors de la conception ou de la rénovation de structures, déterminer la…

Matrice DRAS : définition, principes et exemple pour une meilleure compréhension

Dans le domaine du management stratégique, un outil attire l'attention pour son…

Programmation efficace : maîtriser la valeur absolue en Python

Dans le domaine de la programmation, la compréhension et l'utilisation des concepts…

Récupérer compte Messenger sans Facebook : étapes simples et efficaces

Dans l'ère numérique actuelle, la communication en…

Les avantages d’une clé USB de 1 To pour le stockage de données

Pour ses performances satisfaisantes et ses multiples…

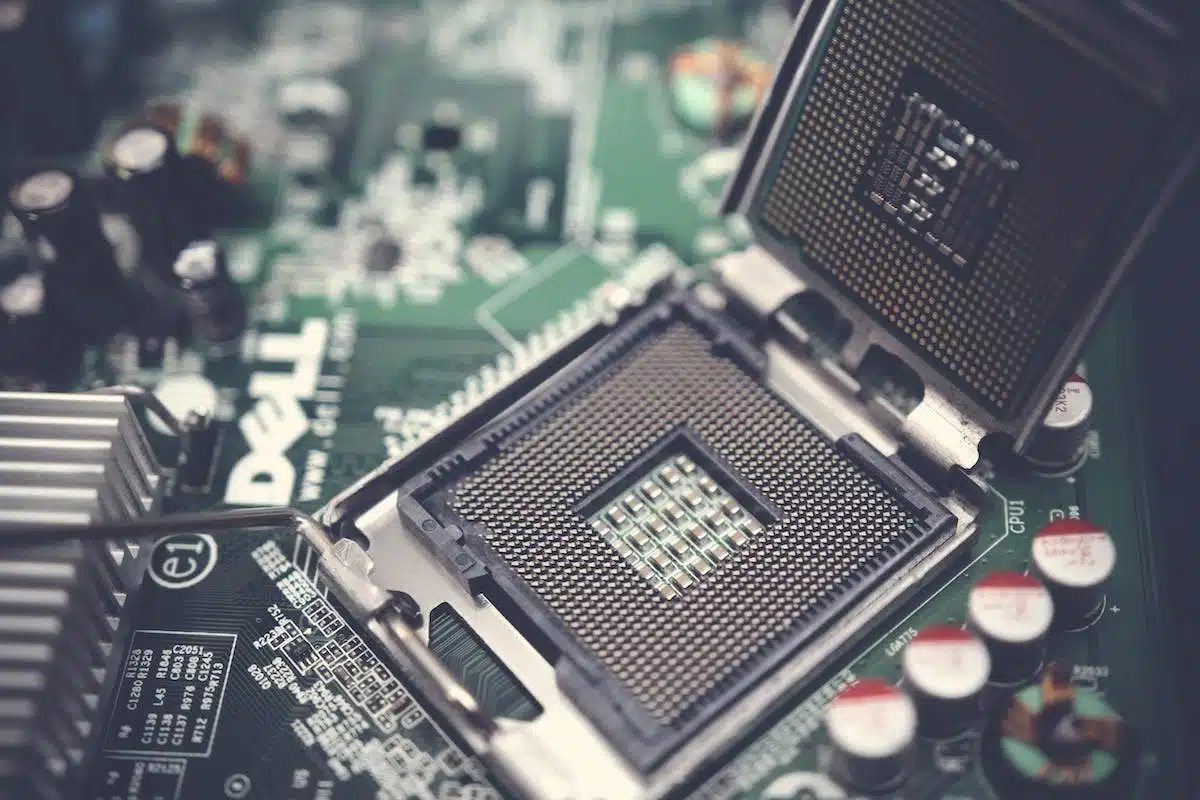

L’évolution de l’intelligence artificielle dans l’informatique : des avancées remarquables

Dans le monde fascinant de l'informatique, l'intelligence…

Les clés d’une stratégie de content marketing réussie pour une entreprise technologique

Dans le monde actuel, hyperconnecté et en constante évolution, les entreprises technologiques…

Les meilleures astuces pour booster le référencement de votre site web et augmenter votre trafic

Dans le monde numérique d'aujourd'hui, un site web est une vitrine virtuelle…

Création de contenu informatique engageant et percutant : Guide des meilleures pratiques SEO

Dans l'univers numérique en constante évolution, la création de contenu informatique engageant…

Maximisez votre visibilité en ligne avec une agence SEO de qualité

Dans le monde numérique en constante évolution, il est essentiel pour les…

HIDS, NIDS, LIDS en cybersécurité : comprendre les différences

Dans l'univers impitoyable de la cybersécurité, la détection des intrusions se présente…

Les astuces indispensables pour une sécurité Wi-Fi optimale à la maison

Dans un monde où l'ère du numérique règne en maître, la sécurité…

Guide ultime pour se protéger contre les attaques de phishing : les meilleures pratiques à adopter

Dans l'ère numérique d'aujourd'hui, le phishing est devenu l'un des modes d'escroquerie…

Décryptage des techniques de phishing courantes et conseils pour les identifier

Dans l'ère numérique actuelle, la cybercriminalité est en constante évolution et le…

Détecter les techniques les plus fréquentes de phishing et les contrer efficacement

Dans un monde où les technologies numériques…

Les meilleures pratiques pour sécuriser vos informations en ligne

Dans un monde numérisé, la sécurité en…

Les dernières évolutions dans la protection des données personnelles : ce que vous devez absolument savoir

L'ère numérique a transformé le monde, rendant…

Les bases essentielles du référencement naturel pour optimiser votre site web

Dans l'ère numérique actuelle, la visibilité en ligne est devenue une nécessité…

Les clés de la rédaction SEO pour optimiser votre contenu web

Dans un monde numérique en constante évolution, la visibilité en ligne est…

Les pièges à éviter pour optimiser votre référencement naturel

Le référencement naturel, ou SEO, est un élément clé de la stratégie…

Optimisez votre classement en ligne grâce à ces 10 meilleures pratiques de référencement

Dans l'ère numérique contemporaine, la visibilité en ligne est essentielle pour toute…

DERNIERS ARTICLES

Webmail AC Aix-Marseille : restez connecté à votre vie académique

Dans le monde dynamique de l'éducation, la communication numérique est essentielle. Pour les étudiants et le personnel de l'académie d'Aix-Marseille,…

Calcul de charge admissible pour poutre IPN : astuces et méthodes

Lors de la conception ou de la rénovation de structures, déterminer la charge admissible pour une poutre IPN est une…

Sublimer vos textes : l’art de l’écriture esthétique

Dans le domaine littéraire, la quête de l'esthétisme à travers les mots est comparable à celle des artistes en peinture…

Réparation ventilateur GPU défectueux : solutions et astuces pratiques

Les cartes graphiques sont des composants essentiels pour les performances graphiques d'un ordinateur, en particulier pour les applications gourmandes telles…

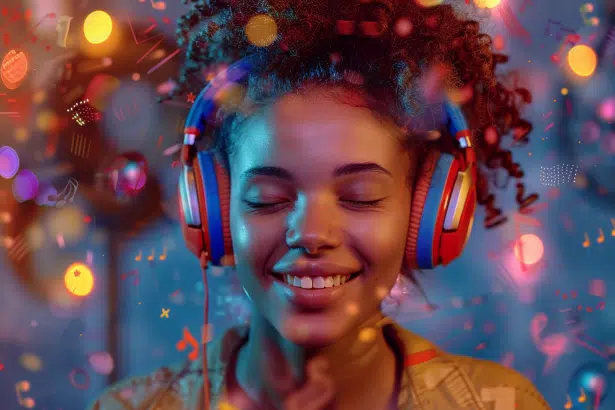

Maximiser votre expérience musicale avec Youzik : astuces et conseils

Dans l'ère numérique actuelle, la musique est plus accessible que jamais grâce aux plateformes de streaming et aux convertisseurs en…

PS5 caractéristiques essentielles : spécifications et performance détaillées

La PlayStation 5, dernière-née des consoles de Sony, a suscité un intérêt mondial sans précédent depuis son lancement. Ses caractéristiques…

Programmation efficace : maîtriser la valeur absolue en Python

Dans le domaine de la programmation, la compréhension et l'utilisation des concepts mathématiques de base est essentielle. En Python, un…

HIDS, NIDS, LIDS en cybersécurité : comprendre les différences

Dans l'univers impitoyable de la cybersécurité, la détection des intrusions se présente comme un rempart essentiel contre les cyberattaques. Trois…

Calcul résistance LED : formule précise et outil en ligne

Correction : Dans le monde de l'électronique, le calcul de la résistance nécessaire pour une LED est une étape fondamentale…

Système adiabatique expliqué : fonctionnement et applications pratiques

Dans le monde fascinant de la physique, le système adiabatique occupe une place de choix, notamment en thermodynamique. C'est un…

Adapter un objectif argentique sur appareil numérique : astuces et étapes

L'ère numérique n'a pas entièrement relégué les objectifs argentiques aux oubliettes. Les photographes passionnés cherchent souvent à marier la qualité…

Comparatif Nintendo Switch V1 vs V2 : tout savoir sur leurs différences

Depuis son lancement, la Nintendo Switch a captivé un large public avec son concept hybride et sa ludothèque variée. La…

Matrice DRAS : définition, principes et exemple pour une meilleure compréhension

Dans le domaine du management stratégique, un outil attire l'attention pour son efficacité dans l'évaluation des ressources d'une entreprise :…

Une sélection de baies de brassage 12U compacte et performante

Pour les installations de réseaux câblés dans des espaces restreints, la baie de brassage 12U offre une solution idéale. Avec…

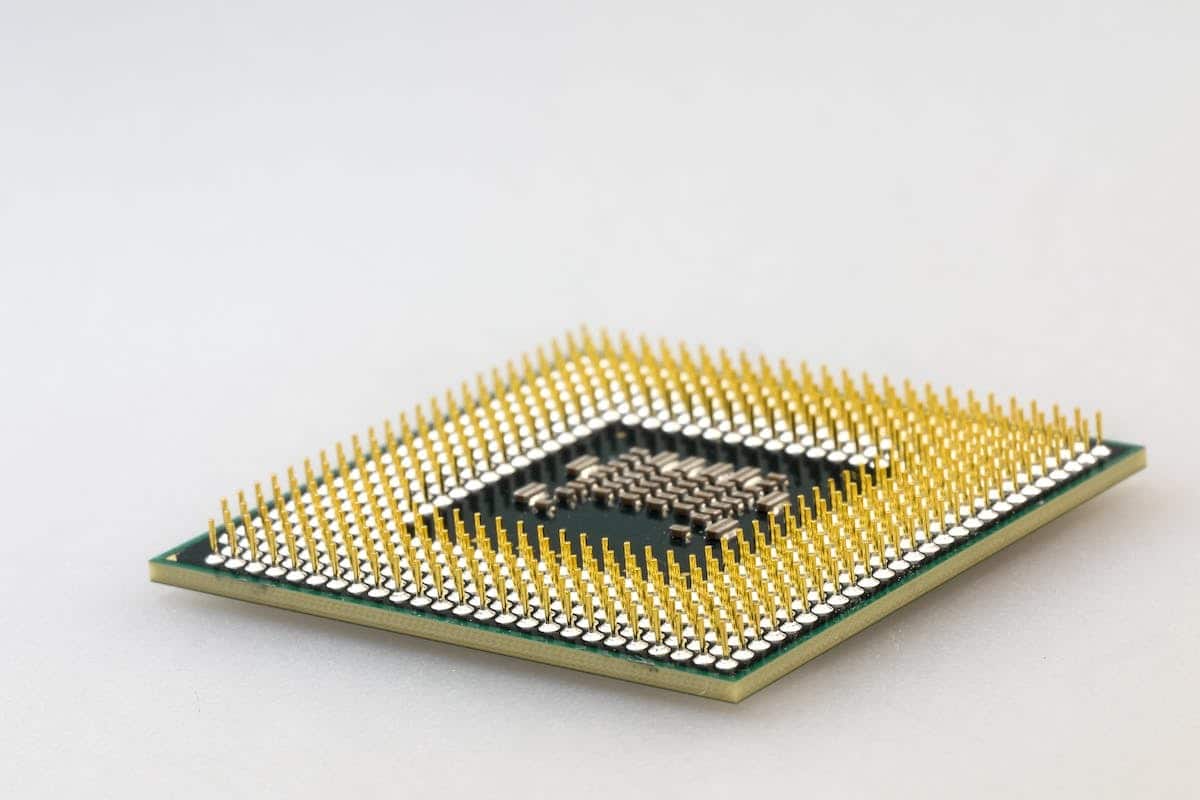

Les dernières évolutions des processeurs : tout ce que vous devez savoir

Dans le monde effréné de la technologie, l'évolution des processeurs reste une composante essentielle à suivre. Ces petits cerveaux électroniques…

Convertir facilement : de 400 ml à centilitres

Dans le monde des mesures de volume, la conversion entre différentes unités est une compétence essentielle en cuisine, en science…

Histoire de l’Odyssey : première console de jeux et son impact sur le gaming

En 1972, l'Odyssey marquait le début d'une révolution avec sa sortie en tant que première console de jeux vidéo de…

Material Design de Google : principes et impact sur l’UX/UI design

Lancé en 2014, Material Design est la réponse de Google à la quête d'une esthétique cohérente et d'une expérience utilisateur…

Fonctionnement des LED sans fil : éclairage innovant et pratique

L'éclairage sans fil représente une avancée significative dans le domaine de la technologie LED. En éliminant le besoin de câbles…

Comparaison ChatGPT-4 vs ChatGPT-3 : performances et évolutions

L'avènement de l'intelligence artificielle transforme notre manière de communiquer, d'apprendre et de rechercher des informations. La série des modèles GPT…

Skynet et IA : risque d’extermination humaine par l’intelligence artificielle

L'évocation de Skynet évoque immédiatement le spectre d'une intelligence artificielle (IA) devenant si avancée qu'elle se retourne contre ses créateurs.…